For years the only changes payroll professionals had to worry about was normal rate changes for state unemployment each year. But in recent years the IRS has made updates to the federal Form 940 and states are in a much different position financially regarding unemployment benefits. Because several states are faced with depleted funds, changes are occurring on payroll unemployment taxes. With the change in the economy and legislation changes happening more often this has become more complicated for both employees and employers.

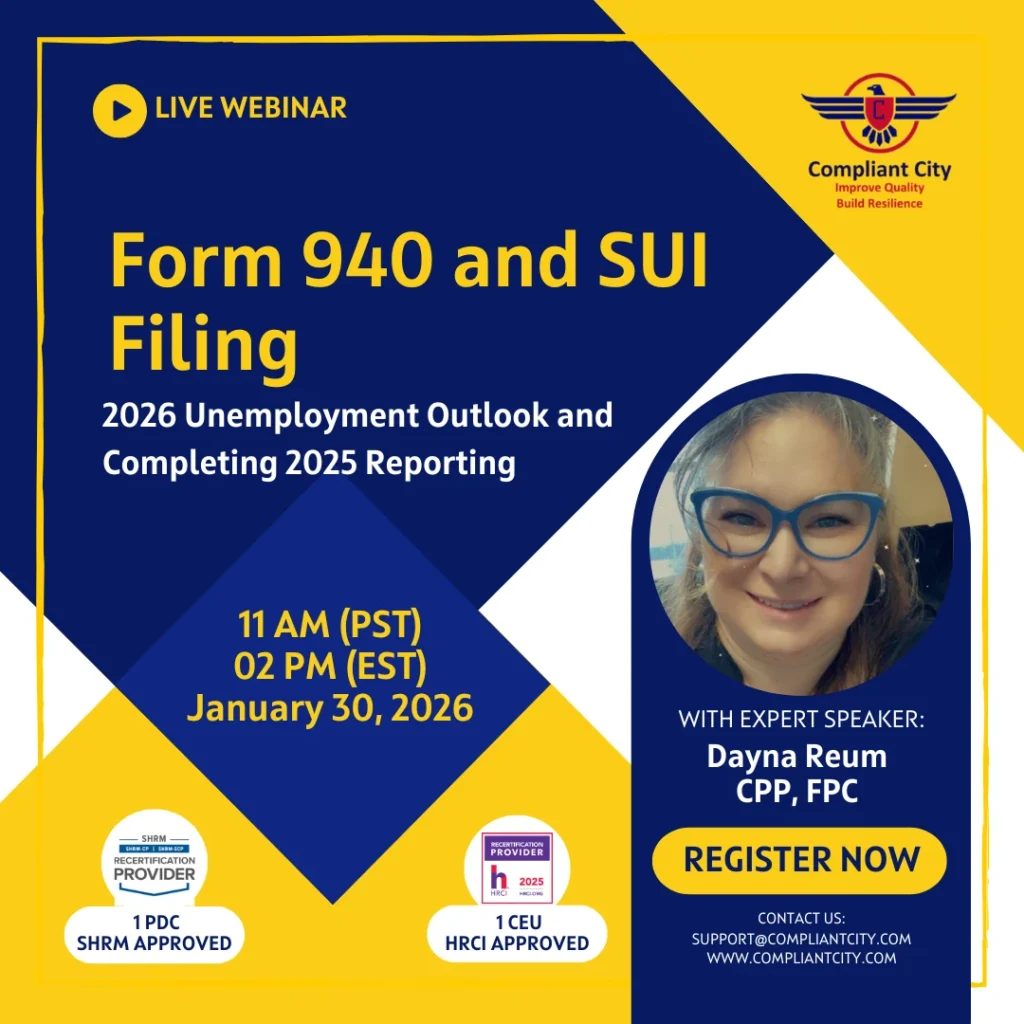

This webinar will review the necessary updates on where our unemployment system is and how this will affect the way payroll professionals will do their jobs now and into the future.

Why you should attend:

With unemployment systems under financial pressure and frequent changes to FUTA and SUI requirements, payroll compliance has become more complex than ever. This webinar will help you stay ahead by clearly explaining Form 940 updates, FUTA credit reduction states, and common filing mistakes that lead to penalties. You’ll gain a practical understanding of how FUTA and SUTA interact, which wages are subject to unemployment taxes, and how economic and legislative changes will impact unemployment reporting in 2026 and beyond. Most importantly, you’ll learn proven strategies to reduce and maintain your SUI rates while avoiding costly compliance errors. Whether you manage payroll, oversee HR, or advise clients, this session equips you with actionable insights to protect your organization, control unemployment tax costs, and confidently handle year-end 2025 reporting and future unemployment tax challenges.

Areas that will be covered during the Session

- Understanding who and what earnings are subject to unemployment taxes

- A review of FUTA tax rate and tax depositing

- Discuss Form 940 changes and common mistakes made

- How FUTA & SUTA interact and why it is important to understand

- Discussion on the status of the state unemployment system and how it will affect your job in the

coming years - Details of the FUTA Credit Reductions

- How to reduce and maintain your SUI rates

Who should attend?

- All Employers

- HR Professionals

- Payroll Professionals

- Business Owners

- Company Leadership

- Compliance professionals

- Managers/Supervisors

After the live event, there will be a Q&A session where you can ask a question directly to our expert speaker. They will provide a clear and understandable response to help you better understand the topic.

Note: After completing your webinar purchase, please check your spam/junk folder in your email for the webinar joining link, which will be sent after the confirmation email.

Reviews

There are no reviews yet.